Advertising optimization can increase performance.

1. High-performing advertising formats are still 'collective' 2. Approximately 1% increase from CTR 1.44% to 2.24% over first ad 3. CPC decreased from KRW 318 to KRW 288 compared to previous campaign

Ad Settings

Ad (material, format) setting 1. (Plan A) Traffic campaign_Ad format 4 (image, video, slide, collection) 2. (Plan B) Traffic campaign_Ad format 1 (collection)

Ad running period (May 15, 2024 ~ May 20, 2024)

Setting cost: 30RM

Exposure location: Advantage+Location

Text 1. 😍Find an online advertising agency quickly! 2. ❤️Find a marketing agency quickly! 3. 🎶Find a marketing agency quickly! 4. 🗣Find a global marketing agency quickly! 5. 😁Find an advertising agency quickly!

Ad material

Slide (created using image)

Collection (set main as video, next as image)

[A/B Test Result]

Goal | Version | Performance | Cost per Result | Result | Reach | Exposure | Expenditure | Confidence Level |

|---|---|---|---|---|---|---|---|---|

Traffic | (A) 2024-05-07| Traffic | 4 ads | Win | 1.22 | 219 | 125000 | 18344 | 267.02 MYR | 86% |

Traffic | (B) 2024-05-06| Traffic | 1 ads | Lose | 1.7 | 94 | 107000 | 20058 | 159.86 MYR | 14% |

Goal | Version | Performance | Cost per Result | Result | Reach | Exposure | Expenditure | Confidence Level |

|---|---|---|---|---|---|---|---|---|

Traffic | (A) 2024-05-16| Traffic | 4 ads | Win | 0.81 | 119 | 2,489 | 4,733 | 96.68 MYR | 86% |

Traffic | (B) 2024-05-16| Traffic | 1 ads | Lose | 1.14 | 74 | 1,828 | 3,726 | 84.72 MYR | 14% |

*The above graph is a figure obtained using the Meta (Facebook) A/B test function. A confidence level of 90% or more means statistically reliable results, and a confidence level of 65% or more means good performance. The above figure is an estimate and does not guarantee the causative result of the study.

Result: Results: 86% confidence in both results, better for "four advertising materials", lower overall for cost per result optimization

[Comparison of Ad Sets]

[Before Ads Set]

Goal | Ad Set | Exposure | Reach | Link Clicks | Clicks (Total) | Result | CTR | CPC |

|---|---|---|---|---|---|---|---|---|

Traffic | (Plan A) 4 Ad Materials | 33,553 | 16,695 | 658 | 655 | 658 | 1.95% | RM1.04 |

Traffic | (Plan B) 1 Ad Material | 20,473 | 12,820 | 97 | 123 | 97 | 0.60% | RM1.34 |

[Present Ads Set]

Results

‘Present Plan A (4 Ad Materials)’ has a higher CTR 0.56% compared to ‘Present Plan B (1 Ad Material)’ / ’Present Ads set’ has a higher CTR 0.54%, 1.33% compared ‘Before Ads set’

Plan A (4 Ad Materials) is 108 KRW cheaper in CPC than Plan B (1 Ad Material) / ’Present Ads set’ is 39 KRW cheaper compared ‘Before Ads set’

Plan A (4 ad creatives) is 705 KRW more expensive in terms of CPM (cost per 1,000 impressions) compared to Plan B (1 ad creative) / Referring to the previous ad set, the CPM for image format ads is typically around 3,000 - 4,000 KRW cheaper.

Plan A (4 ad creatives) accounts for 55% of the total impressions.

[Ad Comparison]

Ad Material Plan A

Ad Format | Exposure | Reach | Link Clicks | Clicks (Total) | Result | CTR | CPC | CPM |

Video | 15 | 15 | 1 | 1 | 1 | 6.67% | RM0.23 | RM15.33 |

Collection | 4,086 | 1,867 | 112 | 111 | 112 | 2.72% | RM0.82 | RM22.28 |

Slide | 620 | 601 | 6 | 6 | 6 | 0.97% | RM0.90 | RM8.69 |

Image | 22 | 14 | - | - | - | - | - | RM3.64 |

Ad Material Plan B

Ad Format | Exposure | Reach | Link Clicks | Clicks (Total) | Result | CTR | CPC | CPM |

|---|---|---|---|---|---|---|---|---|

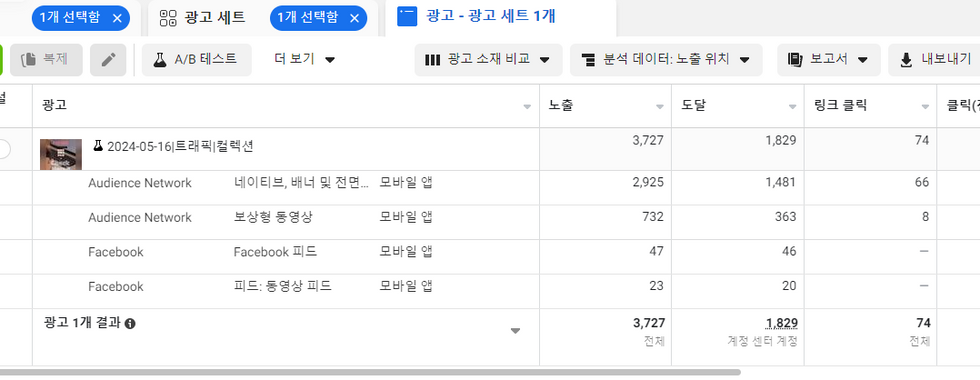

Collection | 3,727 | 1,829 | 74 | 72 | 74 | 1.93% | RM1.18 | RM22.74 |

Results

In the case of 'Plan A (4 ad creatives)', it is possible to confirm that the ads were focused on a specific ad (collection).

In 'Plan A (4 ad creatives)', the CTR was 6.67%, but the sample size was too small, so if we exclude that, the most popular ad is the collection format with a CTR of 2.72%.

Both 'Plan A (4 ad creatives)' and 'Plan B (1 ad creative)' used the same collection, but there was a performance difference of CTR 0.79 and CPC 108 KRW.

Overall, the 'collection ad format' showed the best performance in terms of impressions, reach, and other metrics.

[Uniqueness by Text]

💡 Text-analyzed video, low or low result data in image advertising format, impossible to measure (Image performance: click x, video performance: click 1)

[Exposure Location]

[Before & Present]

Plan A ads (Collection) | Exposure | Reach | Outocme | CTR | CPC | CPM |

Audience Network (Native, Banner and Full screen) | 3,456 | 1,599 | 99 | 2.84% | RM0.83 | RM23.45 |

Audience Network (Rewarded Video) | 610 | 325 | 13 | 2.13% | RM0.74 | RM15.77 |

Plan B ads (Collection) | Exposure | Reach | 결과 | CTR | CPC | CPM |

Audience Network (Native, Banner and Full screen) | 2,925 | 1,481 | 66 | 2.19% | RM1.13 | RM24.63 |

Audience Network (Rewarded Video) | 732 | 363 | 8 | 1.09% | RM1.47 | RM16.05 |

Top Position performance (Written based on results.)

Test A | Test B |

💡 Plan A_4 Ads Materials (image, video, collection, slide)

💡Plan B_1 Ad Material (image)

| 💡 Plan A_4 Ads Materials (image, video, collection, slide)

💡Plan B_1 Ad Material (Collection)

|

Results

Similar to the previous test, the 'Audience Network Native' and 'Audience Network Rewarded' ad placements showed the best performance and the highest number of impressions.

While the 'Facebook Feed' placement was third in the previous ad test, in this test, the 'Facebook Reels' placement took the third position, with a difference of 0.1% in CPR (cost per result), which was 0.5% and 0.4% respectively.

For images and videos, the overall result values are 0 or 1, and the only exception was a result of 6 in the carousel format, but the actual placement-wise results were 2 or 1, so this data has been excluded.